Our Offering

GIFT City Solutions

Taxation

Our Offering

What is Foreign Equity?

Foreign Equity is a unique & customized product offered by Ashutosh Financial Services. It contains personally curated stock portfolios of US-listed stocks. It enables you to invest in the most renowned companies of the world with proper guidance.

1) Geographical Portfolio Diversification:

Foreign equity allows investors to diversify their portfolios beyond their domestic market. This helps spread risk across different economies, industries, and currencies, potentially reducing overall portfolio volatility.

2) Access to Industry Leaders:

Some industries may be more dominant in certain foreign markets than in others. Investing internationally allows investors to access industry leaders and innovators that may not be available in their domestic market (Ex – Google, Apple, Facebook, Microsoft etc.)

3) US Dollar Denominated Exposure :

Investing in foreign equity can provide exposure to US currencies, which can serve as a hedge against currency risk and provide opportunities for currency appreciation.

4) Convenient and Flexible :

Fractional shares of the smallest denomination can be purchased of any U.S.A. based company having very high per share prices. Seamless & convenient user interface through our investment platform (Vested).

Our Customized Portfolios:

Why Ashutosh Financial Services?

Ashutosh Financial Services is a 25+ years old company that has been assisting individuals and companies in various aspects like Investment, Insurance, Income Tax Planning, etc. At Ashutosh Financial Services we always put the investors’ interests first and do our best to ensure that investors’ objectives are achieved in a timely manner. We strive to make every Indian financially literate and independent.

We at Ashutosh Financial Services put maximum importance on understanding your Investment objectives and creating a customized investment plan to ensure the complete achievement of your investment goals. We pride ourselves to be the best goal-based planners. Post Investment, we keep regular track of all your investments to ensure the complete achievement of your investment objectives.

Through our years of experience, we at Ashutosh Financial Services have created a process through which we aim to provide you with the best investment-related services and ensure that you have a hassle-free experience. We have a team of well-qualified and experienced members that are more than enough capable to assist you regarding all your investment matters.

We at Ashutosh Financial Services through our years of experience have created customized portfolios for the sole purpose of investing in US markets. US stock markets are called the Mother Of All Markets and hence everyone should invest there.

Through our extensive research and analysis, we have created 75 personalized portfolios, each on a different theme. We will provide you with a one-stop – Investment & Taxation service. We assure you that through our curated portfolio you will be able to invest in US markets in the best way possible. Our portfolios are best designed for long-term wealth creation.

Preliminary

Discussion

In this discussion, we will explain to you everything in detail about investing in US stocks like – documentation, taxation, etc. We shall also ask you about your investment history and details to better understand your goal. We shall in detail discuss with you all our portfolios.

Investment

Process

Once your goals are ascertained and risks are assessed, we shall contact you again with all the relevant details of the portfolios you should be investing in. The entire process can be done digitally. We shall assist you in the process of documentation and fund transfer, once that is completed successfully, we shall invest the amount to buy the stocks as discussed. The Investment is done in batches depending upon the market situation to take the maximum benefit of any corrections.

After

Investment

Service

Once the investment is completed, you shall be assigned a dedicated Relationship Manager to assist you in all your future queries. Apart from this we also undertake a periodical review of your investments to check whether it is performing as expected or not. If the performance is not as expected, we shall notify you about the changes we should make.

Our aim is to become your one-stop solution for your financial needs. Through our expert and qualified team, we try to give you the best advice regarding your investments. We also keep ourselves updated with all the activities happening in the world of finance. We aim to provide you with quality & unbiased services to secure your goals and future needs. We at Ashutosh Financial Services, are committed to continuously providing financial services to our investors to the best of our ability.

Our USPs are as under

GIFT City Solutions

What is GIFT City?

GIFT City (Gujarat International Finance Tec-City) is India’s first and only International Financial Services Centre (IFSC)—a visionary initiative by the Government of India to bring global financial services to Indian soil with world-class infrastructure, simplified regulations, and competitive tax structures.

Located in Gandhinagar, Gujarat, GIFT City has been developed to cater to businesses in banking, insurance, capital markets, asset management, and allied financial services—all in foreign currency and under one unified regulatory framework.

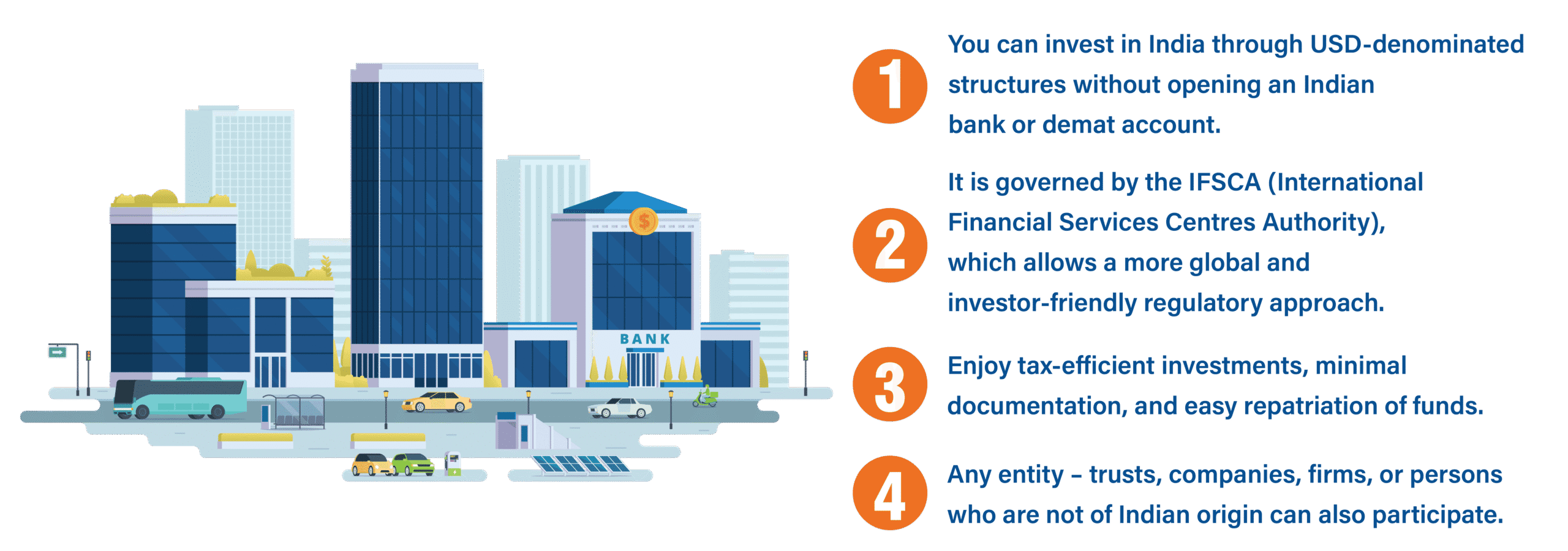

Why GIFT City Solutions?

Outbound Gift City Funds

Ashutosh Financial Services proudly offers end-to-end advisory and execution solutions for investing in Outbound Gift City Funds. These funds provide a unique gateway for Indian investors to diversify their portfolios globally by leveraging the regulatory and fiscal advantages offered by India’s International Financial Services Centre (IFSC), located at GIFT City, Gujarat.

With the growing demand for international exposure, GIFT City has emerged as a robust financial hub that facilitates seamless cross-border investments in a fully regulated and tax-efficient environment. At Ashutosh Financial Services, we guide our clients through every step of the investment process—from selecting the right global fund aligned with their goals and risk profile to ensuring compliance under the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India.

Our deep expertise in global investment vehicles, regulatory frameworks, and market dynamics allows Indian investors—both individuals and institutions—to access opportunities across developed and emerging markets, all while investing through Indian fund platforms housed within the secure and strategic ecosystem of GIFT City.

What are Outbound Gift City Funds?

Outbound Gift City Funds are mutual fund schemes or alternative investment vehicles set up in the IFSC, specifically designed to invest in international assets. These funds allow Indian residents to diversify their portfolios by investing in global equities, ETFs, bonds, and other foreign securities under the Liberalised Remittance Scheme (LRS) of the Reserve Bank of India.

Why Choose Outbound Gift City Funds?

Global Diversification: Gain exposure to international markets, reducing domestic concentration risk.

Tax Efficiency: Enjoy potential tax benefits under the IFSC regime compared to traditional offshore investments.

Ease of Access: Invest in global assets through Indian fund houses with simplified compliance.

INR-Based Investments: Most funds accept investments in Indian Rupees, simplifying the remittance process.

Professional Management: Access to world-class fund managers with expertise in international markets.

Why Ashutosh Financial Services?

At Ashutosh Finserv, we combine deep financial expertise with a commitment to building long-term, trusted relationships. We go beyond standard advisory our approach is to manage, simplify, and optimize your entire financial needs.

• 65+ years of legacy with over two decades of focused expertise in wealth and investment advisory

• Trusted by 5000+ clients across India and 25+ countries, with relationships built and nurtured across generations as a holistic family office.

• Dedicated relationship managers and a team of 65+ seasoned professionals, ensuring personalized and consistent service

• Periodic portfolio reviews and end-to-end financial management tailored to your evolving needs

• Deep understanding of Indian and global financial ecosystems

Our Key USPs are as under

Taxation

Taxation rates for various incomes for resident Indian in India & U.S.A. from investment in direct stocks & stock portfolios.

| Type of Income | Rate of tax in India | Rate of tax in U.S.A. |

|---|---|---|

| Short term capital gains on sale of foreign shares. (When holding period is less than 24 months) | Slab rates of income tax | No Tax for non-U.S. tax residents |

| Long term capital gains on sale of foreign shares (When holding period is more than 24 months) | 20% (With indexation benefit) | |

| Dividend from U.S. shares. (As per Double Taxation Avoidance Agreement – DTAA of India with U.S.A.) | Slab rates of income tax | 25% |

Taxation rates for various incomes for resident Indian in India & U.S.A. from investment in foreign equity based mutual funds & ETFs in India.

| Type of Income | Rate of tax in India | Rate of tax in U.S.A. |

|---|---|---|

| Short term capital gains on sale of units of mutual fund. (When holding period is less than 36 months) | Slab rates of income tax | |

| Long term capital gains on sale of units of mutual fund. (When holding period is more than 36 months) | 20% (With indexation benefit) | No Tax since there is no income outside India |

| Dividend from units of mutual fund. | Slab rates of income tax |