Mutual Fund

Taxation

FAQs

Mutual Fund

Investing in Mutual Funds:

An Investor may start with equity-oriented funds, debt-oriented funds, or hybrid (equity + debt) oriented funds depending on the investment objectives and risk tolerance of an investor.

Through Mutual Funds, one can not only create wealth but also minimize the market risk factor by a technique called averaging which can be achieved through a Systematic Investment Plan (SIP) – monthly automatic investments and Systematic Transfer Plan (STP) – periodically transferring funds from Debt to Equity.

Investing in Mutual funds is an ideal choice for investors who do not wish to invest in equities directly. Direct investment in stocks requires a detailed analysis of the company, its working & its fundamentals which is generally a time-consuming task. However in Mutual funds a professional team of experts and qualified individuals invest your money on your behalf into the stock market. All the researching and analysing of the companies is done by these qualified individuals. Each Mutual fund scheme is handled by a fund manager who has a vast experience of dealing into the stock market.

Why invest in Mutual Funds?

Can Non-resident Indian (NRI) invest in mutual funds in India?

NRIs are allowed to invest in mutual funds in India– as long as they adhere to the rules of the Foreign Exchange Management Act (FEMA). However, some Asset Management Companies (AMCs) do not accept mutual fund applications from tax residents of Canada & USA and some has restrictions over online investment transactions. Click here to know more.

Categories of Mutual Funds:

All Asset Management Companies (AMC) follows the mandate of Security Exchange Board of India (SEBI) and launches the Mutual funds as:

The funds are categorized as:

- Equity Oriented Funds – Equity Funds are mutual fund schemes which invest in stocks of different companies; based on the investment objective of the underlying scheme. These funds are comparatively riskier than other types of Mutual funds; but has great investment options for capital appreciation as they have the potential for long term wealth creation.

- Debt Funds – A debt fund is a Mutual Fund that aim to generate returns by investing in fixed income instruments, such as corporate & Government bonds, corporate debt oriented securities and money market related instruments.

- Hybrid Funds – Hybrid Funds are mutual fund schemes which invest in more than one asset class i.e. equity, debt and other asset classes depending on the investment objective of the scheme. These funds invest in a mix of different asset classes to diversify the portfolio with an aim to minimise the risk involved.

- Solution Oriented Schemes – Solution Oriented Funds are customisable as per the future financial requirement of an investor. These funds are long term income funds. This fund helps in building a corpus which further ensures adequate capital for a specific objective.

- Other Schemes: – This category invests in all the companies that make up the particular index, which gives an investor more diverse portfolio than if he is buying individual stocks. Index funds follow a benchmark of index like Sensex, Nifty 50, S&P 500 or Nasdaq 100 to invest in them as per the allocation similar to these benchmarks.

Lumpsum Investment

A Lumpsum investment is when an investor makes an independent investment in a particular scheme in a single transaction. A lumpsum investment is generally preferred by investors with high net worth and high risk taking capacity. Lumpsum investment if executed perfectly during the market correction has the potential to generate enormous returns.

SIP – Systematic Investment Plan

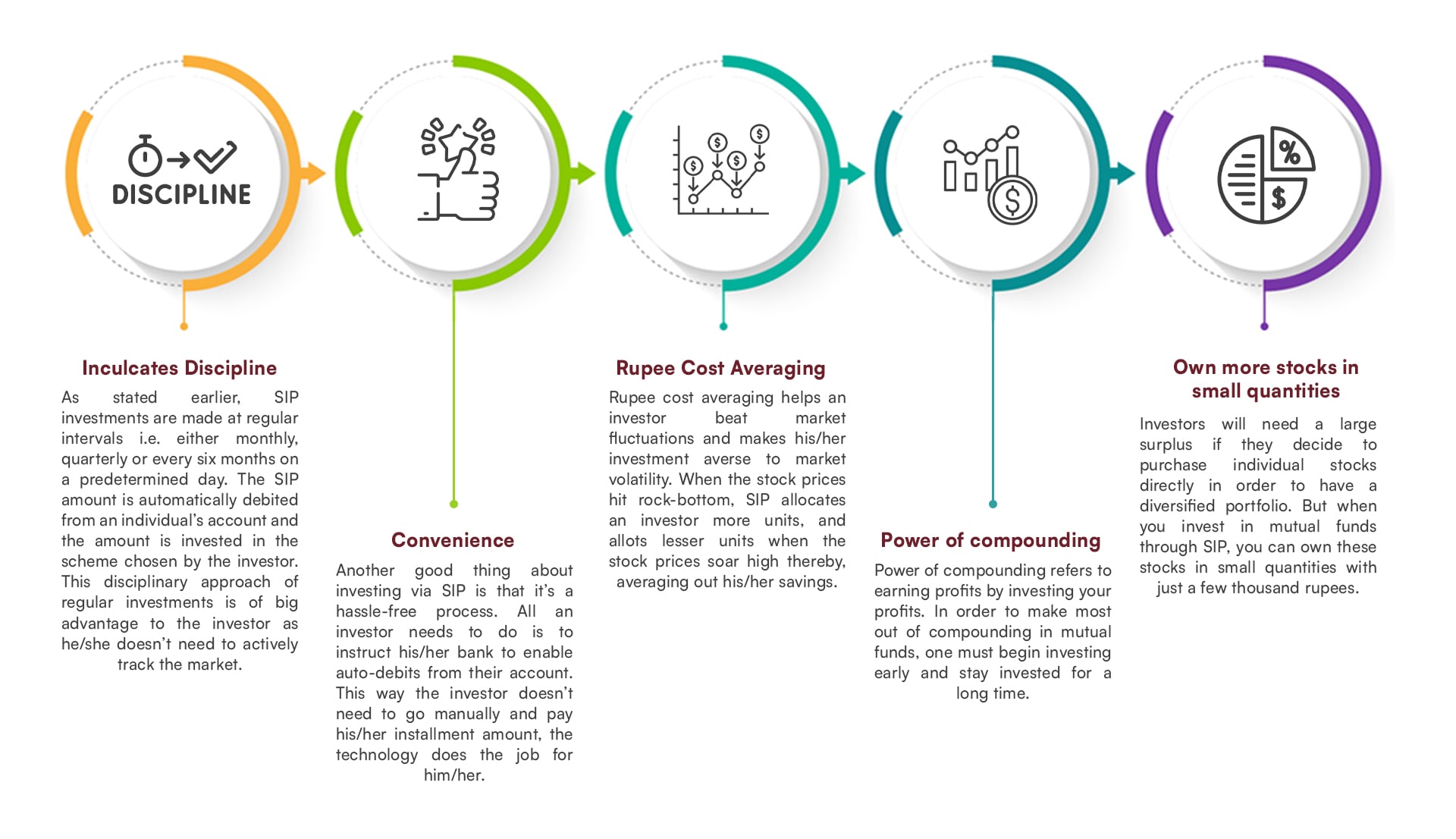

A SIP is the process where an investor invests a fixed amount of money in a particular mutual scheme at regular intervals (usually monthly). Generally in a SIP the investment amount, tenure of the investment and the periodicity of the investment is predetermined. SIP solves the biggest problem for investors - Timing. We as investors always wish to time the market and invest at the right time. However with years of experience we have understood that the markets can never be correctly timed and hence it is better to invest regularly through an SIP. Another added advantage of SIP is that it inculcates a habit of savings which in turn helps an investor in cases of emergencies.

Why SIP?

STP – Systematic Transfer Plan

An STP is a regular transfer from one fund to another. It is like an SIP but the source of the money is an STP from another fund. The most frequent use of an STP is when you have a lump sum to invest in an equity scheme. For reasons listed above, it is always better to invest gradually through an SIP rather than with a large sum all at once. In such cases, you could put the lump sum in a debt fund and simply give instructions to transfer a fixed amount into a chosen equity scheme every month. This is called STP. The investor needs to select a fund from which the transfer should take place and a fund to which the transfer is taking place. Transfers can be made daily, weekly, monthly or quarterly depending upon the STP chosen and the options available with the AMC. If an investor chooses to transfer from a liquid fund to an equity fund, the lump sum is invested in a liquid or a floating short-term plan and is transferred at regular intervals to a specified equity fund.

SWP – Systematic Withdrawal Plan

SWPs are regular redemption from a scheme. There are a number of variations. Investors can either redeem a fixed amount, a fixed number of units or all returns above a certain base level. Among other things, they are a convenient way to take a regular income from a mutual fund investment. An SWP allows you to withdraw a fixed sum of money every month or quarter depending on the option chosen and instructions given by you.

Taxation

Capital Gain Taxation :

| Sr. No. | Nature of Income | Rate of Capital Gain |

|---|---|---|

| 1 | Short Term Capital Gain (Equity Oriented Schemes) | 15% |

| 2 | Short Term Capital Gain (Other than Equity Oriented Scheme) | As per slab rate |

| 3 | Long Term Capital Gain (Equity Oriented Schemes) | 10% (to be levied on long-term capital gains exceeding Rs. 1 lakh) |

| 4 | Long Term Capital Gain (other than Equity Oriented Schemes) | 10% (without indexation for unlisted) 20% (with indexation for listed) |

Dividend incomes on Mutual Funds are taxed at the rate of 20%

Tax Deducted at Source (TDS) implications on various Income:

| Sr. No. | Nature of Income | Rate of TDS |

|---|---|---|

| 1 | Dividend from Mutual Fund | 20% |

| 2 | Short Term Capital Gain (Equity Oriented Schemes) | 15% |

| 3 | Short Term Capital Gain (Other than Equity Oriented Schemes) | 30% |

| 4 | Long Term Capital Gain (Equity Oriented Schemes) | 10% (to be levied on long - term capital gains exceeding Rs. 1 lakh) |

| 5 | Long Term Capital Gain (other than Equity Oriented Schemes) | 10% (without indexation for unlisted) 20% (with indexation for listed) |

FAQs

Mutual fund is a mechanism for pooling money by issuing units to the investors and investing funds in securities in accordance with objectives as disclosed in the offer document.

Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is diversified because all stocks may not move in the same direction in the same proportion at the same time. Mutual funds issue units to the investors in accordance with the quantum of money invested by them. Investors of mutual funds are known as unitholders.

The profits or losses are shared by investors in proportion to their investments. Mutual funds normally come out with many schemes which are launched from time to time with different investment objectives. A mutual fund is required to be registered with the Securities and Exchange Board of India (SEBI) before it can collect funds from the public.

Unit Trust of India was the first mutual fund set up in India in the year 1963. In the late 1980s, the Government allowed public sector banks and institutions to set up mutual funds. In the year 1992, Securities and Exchange Board of India (SEBI) Act was passed. The objectives of SEBI are – to protect the interest of investors in securities and to promote the development of and to regulate the securities market.

As far as mutual funds are concerned, SEBI formulates policies, regulates, and supervises mutual funds to protect the interest of the investors. SEBI notified regulations for mutual funds in 1993. Thereafter, mutual funds sponsored by private sector entities were allowed to enter the capital market. The regulations were fully revised in 1996 and have been amended thereafter from time to time. SEBI has also issued guidelines through circulars to mutual funds from time to time to protect the interests of investors.

All mutual funds whether promoted by the public sector or private sector entities including those promoted by foreign entities are governed by the same set of Regulations. There is no distinction in regulatory requirements for these mutual funds and all are subject to monitoring and inspections by SEBI.

A mutual fund is set up in the form of a trust, which has sponsor, trustees, Asset Management Company (AMC) and custodian. The trust is established by a sponsor or more than one sponsor who is like promoter of a company. The trustees of the mutual fund hold its property for the benefit of the unit holders. AMC approved by SEBI manages the funds by making investments in various types of securities. Custodian, who is required to be registered with SEBI, holds the securities of various schemes of the fund in its custody. The trustees are vested with the general power of superintendence and direction over AMC. They monitor the performance and compliance of SEBI Regulations by the mutual fund.

SEBI Regulations require that at least two-thirds of the directors of trustee company or board of trustees must be independent i.e. they should not be associated with the sponsors. Also, 50% of the directors of AMC must be independent.

All mutual funds are required to be registered with SEBI before they launch any scheme.

The performance of a particular scheme of a mutual fund is denoted by Net Asset Value (NAV).

Mutual funds invest the money collected from investors in securities markets. In simple words, NAV is the market value of the securities held by the scheme. Since the market value of securities changes every day, NAV of a scheme also varies on day to day basis. The NAV per unit is the market value of securities of a scheme divided by the total number of units of the scheme on any particular date. For example, if the market value of securities of a mutual fund scheme is INR 200 lakh and the mutual fund has issued 10 lakh units of INR 10 each to the investors, then the NAV per unit of the fund is INR 20 (i.e.200 lakh/10 lakh). NAV is required to be disclosed by the mutual funds daily.

The NAV per unit of all mutual fund schemes has to be updated on AMFI‟s website and the Mutual Funds‟ website by 9 p.m. of the same day. Fund of Funds is allowed time till 10 a.m. the following business day to update the information.

Liquid schemes – Subscription

- Where the application is received up to 2.00 p.m. on a day and funds are available for utilization before 2:00 p.m. without availing any credit facility, the closing NAV of the day immediately proceeding the day of receipt of

- Where the application is received after 2.00 p.m. on a day and funds are available for utilization on the same day without availing any credit facility, the closing NAV of the day immediately preceding the next business day; and

- Irrespective of the time of receipt of application (before or after 2:00 p.m. on a day), where the funds are not available for utilization before 2:00 p.m. without availing any credit facility, the closing NAV of the day immediately preceding the day on which the funds are available for

Liquid schemes – Redemption

- Where the application is received up to 3.00 pm – the closing NAV of the day immediately preceding the next business day; and

- Where the application is received after 3.00 pm – the closing NAV of the next business

Other than Liquid Schemes – Subscription

For amount less than INR 2 lakh

- Where the application is received up to 3:00 p.m., closing NAV of the day on which the application is

- Where the application is received after 3:00 p.m., closing NAV of the next business

For amount equal to or more than INR 2 lakh

- Where the application is received up to 3:00 p.m. and funds are available for utilization before 3:00 p.m., closing NAV of the day on which the application is

- Where the application is received after 3:00 p.m. and funds are available for utilization, closing NAV of the next business

- Irrespective of the time of receipt of application (before or after 3:00 p.m.), where the funds are not available for utilization, closing NAV of the day on which the funds are available for utilization.

Other than Liquid Schemes – Redemption

- Where the application is received up to 3.00 pm – closing NAV of the day on which the application is received; and

Where the application is received after 3.00 pm – closing NAV of the next business day.

Schemes according to Maturity Period:

A mutual fund scheme can be classified into open-ended scheme or close-ended scheme depending on its maturity period.

Open-ended Fund/Scheme:

An open-ended fund or scheme is available for subscription and repurchase continuously. These schemes do not have a fixed maturity period. Investors can conveniently buy and sell units at Net Asset Value (NAV) per unit which is declared daily. The key feature of open-end schemes is liquidity.

Close-ended Fund/Scheme:

A close-ended fund or scheme has a stipulated maturity period e.g. 3-5 years. The fund is open for subscription only during a specified period at the time of the launch of the scheme. Investors can invest in the scheme at the time of the new fund offer and thereafter they can buy or sell the units of the scheme on the stock exchanges where the units are listed. In order to provide an exit route to the investors, some close-ended funds give an option of selling back the units to the mutual fund through periodic repurchase at NAV related prices. SEBI Regulations stipulate that at least one of the two exit routes is provided to the investor i.e. either repurchase facility or through listing on stock exchanges.

Schemes according to Investment Objective:

A scheme can also be classified as a growth scheme, income scheme, or balanced scheme considering its investment objective. Such schemes may be open-ended or close-ended schemes as described earlier. Such schemes may be classified mainly as follows:

Growth/Equity Oriented Scheme:

The aim of growth funds is to provide capital appreciation over the medium to long- term. Such schemes normally invest a major part of their corpus in equities. Such funds have comparatively high risks. These schemes provide different options to the investors like dividend option, growth, etc. and the investors may choose an option depending on their preferences. The investors must indicate the option in the application form. The mutual funds also allow the investors to change the options at a later date. Growth schemes are good for investors having a long-term outlook seeking appreciation over a period of time.

Income/Debt Oriented Scheme:

The aim of income funds is to provide regular and steady income to investors. Such schemes generally invest in fixed income securities such as bonds, corporate debentures, Government securities, and money market instruments. Such funds are less risky compared to equity schemes.

However, opportunities for capital appreciation are also limited in such funds. The NAVs of such funds are affected because of changes in interest rates in the country. If the interest rates fall, NAVs of such funds are likely to increase in the short run and vice versa. However, long term investors may not bother about these fluctuations.

Balanced/Hybrid Scheme:

The aim of balanced schemes is to provide both growth and regular income as such schemes invest both in equities and fixed income securities in the proportion indicated in their offer documents. These are appropriate for investors looking for moderate growth. They generally invest 40-60% in equity and debt instruments. These funds are also affected because of fluctuations in share prices in the stock markets. However, NAVs of such funds are likely to be less volatile compared to pure equity funds.

Money Market or Liquid Schemes:

These schemes are also income schemes and their aim is to provide easy liquidity, preservation of capital and moderate income.

These schemes invest exclusively in short-term instruments such as treasury bills, certificates of deposit, commercial paper and inter-bank call money, government securities, etc. Returns on these schemes fluctuate much less compared with other funds. These funds are appropriate for corporate and individual investors as a means to park their surplus funds for short periods.

Gilt Funds:

These funds invest exclusively in government securities. Government securities have no default risk. NAVs of these schemes also fluctuate due to change in interest rates and other economic factors as is the case with income or debt oriented schemes.

Index Funds:

Index Funds replicate the portfolio of a particular index such as the BSE Sensitive index (Sensex), NSE 50 index (Nifty), etc. These schemes invest in the securities in the same weightage comprising of an index. NAVs of such schemes would rise or fall in accordance with the rise or fall in the index, though not exactly by the same percentage due to some factors are known as “tracking error” in technical terms. Necessary disclosures in this regard are made in the offer document of the mutual fund scheme.

These are the funds/schemes which invest in the securities of only those sectors or industries as specified in the offer documents, e.g., Pharmaceuticals, Software, Fast Moving Consumer Goods (FMCG), Petroleum stocks, Information Technology (IT), Banks, etc. The returns in these funds are dependent on the performance of the respective sectors/industries. While these funds may give higher returns, they are riskier compared with diversified funds, investors need to keep a watch on the performance of those sectors/industries and must exit at an appropriate time. They may also seek the advice of an expert.

These schemes offer tax rebates to the investors under specific provisions of the Income Tax Act, 1961 as the Government offers tax incentives for investment in specified avenues, for example, Equity Linked Savings Schemes (ELSS) under section 80C and Rajiv Gandhi Equity Saving Scheme (RGESS) under section 80CCG of the Income Tax Act, 1961. Pension schemes launched by mutual funds also offer tax benefits. These schemes are growth oriented and invest pre-dominantly in equities. Their growth opportunities and risks associated are like any equity-oriented scheme.

A scheme that invests primarily in other schemes of the same mutual fund or other mutual funds is known as an FoF scheme. An FoF scheme enables the investors to achieve greater diversification through one scheme. It spreads risks across a greater universe.

ETFs are mutual fund units that investors can buy or sell at the stock exchange. This is in contrast to a normal mutual fund unit that an investor buys or sells from the AMC (directly or through a distributor). In the ETF structure, the AMC does not deal directly with investors or distributors. Units are issued to a few designated large participants called Authorised Participants (APs). The APs provide buy and sell quotes for the ETFs on the stock exchange, which enable investors to buy and sell the ETFs at any given point of time when the stock markets are open for trading.

ETFs therefore, trade like stocks and experience price changes throughout the day as they are bought and sold. Buying and selling ETFs requires the investor to have Demat and trading accounts.

A capital protection-oriented scheme is typically a hybrid scheme that invests significantly in fixed-income securities and a part of its corpus in equities. These are close-ended schemes that come in tenors of fixed maturity e.g. three to five years.

Structure of the scheme – Example

If the fund collects INR 100, it invests INR 80 in fixed-income securities and INR 20 in equities or equity related instruments. The money is invested in such a way that the INR 80 portion is expected to grow to become INR 100 in three years (assuming that the scheme has a maturity period of three years). Thus, the aim is to preserve the INR 100 capital till the maturity of the scheme.

Thus, the scheme is oriented towards the protection of capital and not with guaranteed returns. Further, the orientation towards the protection of capital originates from the portfolio structure of the

Scheme and not from any bank guarantee or insurance cover. Investors are neither offered any guaranteed/indicated returns nor any guarantee on repayment of capital by the scheme.

A Load Fund is one that charges a percentage of NAV for entry or exit and the load structure in a scheme has to be disclosed in its offer documents. Suppose the NAV per unit is INR 10. If the entry as well as exit load charged is 1%, then the investors who buy would be required to pay INR 10.10 (10 + 1% of 10) per unit and those who offer their units for repurchase to the mutual fund will get only INR 9.90 (10 – 1% of 10) per unit. Currently, in India, the exit load charged is credited to the scheme. The investors should consider the loads while investing as these affect their returns. However, the investors should also consider the performance track record and service standards of the mutual fund which are more important. A no-load fund does not charge for entry or exit. It means the investors can enter the fund/scheme at NAV and no additional charges are payable on the purchase or sale of units.

SEBI has mandated that no entry load can be charged for any mutual fund scheme in India.

Mutual funds cannot increase the exit load beyond the level mentioned in the offer document. Any change in the load will apply only to prospective investments and not to the original investments. In case of imposition of fresh loads or increase in existing loads, the mutual funds are required to amend their offer documents so that the new investors are aware of loads at the time of investments. As no entry load can be charged for mutual fund schemes in India, no change can be made with respect to entry load.

The price or NAV a unit holder is charged while investing in an open-ended scheme is called sales price.

Repurchase or redemption price is the price or NAV at which an open-ended scheme purchase or redeems its units from the unit holders. It may include exit load, if applicable.

Expense ratio represents the annual fund operating expenses of a scheme, expressed as a percentage of the fund’s daily net assets. Operating expenses of a scheme are administration, management, advertising related expenses, etc.

An expense ratio of 1% per annum means that each year 1% of the fund’s total assets will be used to cover expenses. Information on the expense ratio that may be applicable to a scheme is mentioned in the offer document. Currently, in India, the expense ratio is fungible, i.e., there is no limit on any particular type of allowed expense as long as the total expense ratio is within the prescribed limit. For limits on expense ratio, refer to regulation 52 of the SEBI (Mutual Funds) Regulations, 1996.

CAS details all the transactions and investor‟s holding at the end of the month including transaction charges paid to the distributor, across all schemes of all mutual funds, by an investor.

A CAS for each calendar month is issued to the investors in whose folios transactions have taken place during that month.

A CAS every half yearly (September/ March) is issued, detailing holding at the end of the six months, across all schemes of all mutual funds, to all such investors in whose folios no transaction has taken place during that period.

As stated above, no entry load can be charged for any mutual fund scheme. An investor can choose to pay a distributor based on the investor‟s assessment of various factors including the service rendered by the distributor. However, for investments made through a distributor, the commission is paid directly by AMC to the distributor such that the total expense ratio for an investor is within the limits on expense ratio specified under regulation 52 of the SEBI (Mutual Funds) Regulations, 1996. Hence, the cost borne by investors remains within the limit prescribed under SEBI Regulations.

Transaction Charge:

Further, a transaction charge of INR 150 and INR 100 per subscription of INR 10,000 and above by a new and an existing investor, respectively, can be levied by the distributor. This transaction charge can be levied only if a distributor has opted in to levy a transaction charge for that type of mutual fund scheme. Further, the transaction charge, if any, is to be deducted by the AMC from the subscription amount and paid to the distributor; and the balance is to be invested.

Can a mutual fund change the asset allocation while deploying funds of investors?

Considering the market trends, any prudent fund manager can change the asset allocation, i.e., he can invest higher or lower percentage of the fund in equity or debt instruments compared to what is disclosed in the offer document. It can be done on a short term basis on defensive considerations i.e. to protect the NAV. Hence, the fund managers are allowed certain flexibility in altering the asset allocation considering the interest of the investors. In case the mutual fund wants to change the asset allocation on a permanent basis, they are required to inform the unit holders and give them the option to exit the scheme at prevailing NAV without any load.

Investors can contact the agents and distributors of mutual funds who are spread all over the country for necessary information and application forms. Investors must ensure that they invest through Association of Mutual Funds in India (AMFI) registered distributors and that the distributor has a valid AMFI Registration Number (ARN).

Whether a distributor is AMFI registered or not and whether he/she has been suspended/terminated from doing mutual fund business may be checked at http://www.amfiindia.com/locate-the-nearest-financial-advisor. An employee of a corporate distributor is also required to have an Employee Unique Identification Number (EUIN).

The distributors are required to disclose all the commissions (in the form of trail commission or any other mode) payable to them for the different competing schemes of various mutual funds from amongst which the scheme is being recommended to the investor.

Forms can be deposited with mutual funds through the agents and distributors who provide such services. These days, post offices and banks also distribute the units of mutual funds. However, the investors may please note that the mutual fund schemes being marketed by banks and post offices should not be taken as their schemes and no assurance of returns is given by them. The only role of banks and post offices is to help in the distribution of mutual funds schemes to the investors.

Investors should not be carried away by commission/gifts, if any, given by agents/distributors for investing in a particular scheme. On the other hand, they must consider the track record of the mutual fund/scheme and should take objective decisions.

Investors also have the option to invest directly with the mutual fund either by visiting the mutual fund branch or online through the Mutual Fund website.

Investors should also refer to the product labeling of the scheme. All the mutual funds are required to label their schemes on the following parameters:

- Nature of scheme such as to create wealth or provide regular income in an indicative time horizon (short/ medium/ long term).

- A brief about the investment objective (in a single line sentence) followed by the kind of product in which the investor is investing (Equity/Debt).

- Level of risk depicted by a pictorial meter (known as a riskometer) as under:

- Low – principal at low risk

- Moderately Low – principal at moderately low risk

- Moderate – principal at moderate risk

- Moderately High – principal at moderately high risk

- High – principal at high risk

However, investors should consult their financial advisers if they are not clear about the suitability of the product.

Product label is prominently disclosed in:

- Frontpage of initial offering application forms, Key Information Memorandum (KIM), and Scheme Information Documents (SIDs).

- Common application form – along with the information about the

Scheme advertisements.

An investor must mention clearly his name, address, number of units applied for, and such other information as required in the application form. Know your Customer (KYC) documents need to be submitted by a first time investor.

SEBI has mandated mutual funds to compulsorily launch a direct plan for direct investments, i.e., investments not routed through a distributor, from 01 January 2013. Such a separate plan has a lower expense ratio excluding distribution expenses, commission, etc., and no commission is to be paid from such plans. The plan also has a separate NAV.

Investment can be made in a lump sum, i.e. a onetime payment, or through a Systematic Investment Plan (SIP).

A SIP allows an investor to invest regularly. One puts in a small amount every month that is invested in a mutual fund.

A SIP allows one to take part in the stock market without trying to second-guess its movements.

For example

X decides to invest INR 1,000 per month for a year.

When the market price of shares fall, X benefits by purchasing more units; and is protected by purchasing less when the price rises as explained below.

Date | NAV | Approx number of units you will get at 1000 |

1-Jan | 10.00 | 100.00 |

1-Feb | 10.50 | 95.24 |

1-Mar | 11.00 | 90.91 |

1-Apr | 9.50 | 105.26 |

| 1-May | 9.00 | 111.11 |

1-Jun | 11.50 | 86.96 |

1-Jul | 11.00 | 90.91 |

1-Aug | 10.50 | 95.24 |

1-Sep | 10.00 | 100.00 |

1-Oct | 9.50 | 105.26 |

1-Nov | 10.00 | 100.00 |

1-Dec | 9.50 | 105.26 |

1186.15 |

Within one year, X has 1,186 units by investing just INR 1,000 every month at an average cost of 12000/1186.15 = 10.1170. This is as against 12,000/10 = 1,000 units or 12000/11.5 = 1043.5 units or 12000/9 = 1,333.3 units if X had invested lump sum on 1 Jan, 1 Jun or 1 May, respectively.

Yes, non-resident Indians can also invest in mutual funds. Necessary details in this respect are given in the offer documents of the schemes.

An investor should take into account his risk taking capacity, age factor, financial position, etc. As already mentioned, the schemes invest in a different type of securities as disclosed in the offer documents and offer different returns and risks.

Investors may also consult financial experts before taking decisions.

An abridged offer document [known as Key Information Memorandum (KIM)], which contains very useful information, is required to be given to the prospective investor by the mutual fund.

The application form for subscription to a scheme is an integral part of the offer document. SEBI has prescribed minimum disclosures in the offer document. Mutual fund investments are subject to market risks. An investor should carefully read all the scheme related documents. Due care must be given to portions relating to main features of the scheme, risk factors and recurring expenses to be charged to the scheme, loads, sponsor‟s track record, educational qualification and work experience of the key personnel including fund managers, the performance of other schemes launched by the mutual fund in the past, pending litigations and penalties imposed, etc.

As a unit holder, how much time will it take to receive dividends/repurchase proceeds?

A mutual fund is required to dispatch to the unit holders the dividend warrants within 30 days of the declaration of the dividend and the redemption or repurchase proceeds within 10 working days from the date of redemption or repurchase request made by the unit holder.

In case of failure to dispatch the redemption/repurchase proceeds within the stipulated time period, Asset Management Company is liable to pay interest as specified by SEBI from time to time (15% at present) for the period of delay.

Yes. However, no change in the nature or terms of the scheme, known as fundamental attributes of the scheme e.g. structure, investment pattern, etc., can be carried out unless written communication is sent to each unit holder and an advertisement is given in one English daily newspaper having nationwide circulation and in a newspaper published in the language of the region where the head office of the mutual fund is situated. The unit holders have the right to exit the scheme at the prevailing NAV without any exit load if they do not want to continue with the scheme. The mutual funds are also required to follow a similar procedure while converting the scheme from close-ended to open-ended scheme.

The performance of a scheme is reflected in its NAV which is disclosed on daily basis. The NAVs of mutual funds are required to be published on the websites of mutual funds. All mutual funds are also required to put their NAVs on the website of Association of Mutual Funds in India (AMFI) www.amfiindia.com and thus the investors can access NAVs of all mutual funds in one place. Also, each MF is required to have a dashboard on its website providing performance and key disclosures pertaining to each scheme managed by AMC.

The mutual funds are also required to publish their performance in the form of half-yearly results which also include their returns over a period of time i.e. last six months, 1 year, 3 years, 5 years, and since the inception of schemes. Investors can also look into other details like percentage of expenses of total assets as these affect the return and other useful information in the same half-yearly format.

The mutual funds are also required to send annual reports or abridged annual reports to the unit holders at the end of the year.

Investors can compare the performance of their schemes with those of other mutual funds under the same category. They can also compare the performance of equity oriented schemes with the benchmarks like BSE Sensitive Index, Nifty, etc.

Based on the performance of the mutual funds, the investors should decide when to enter or exit from a mutual fund scheme.

The mutual funds are required to disclose full portfolios of all of their schemes on a monthly basis on their website. Portfolio disclosure on a half yearly basis is published in the newspapers. Mutual funds may also send the disclosure of half-yearly portfolios to their unit holders.

The scheme portfolio shows investment made in each security i.e. equity, debentures, money market instruments, government securities, etc., and their quantity, market value, and % to NAV. These portfolio statements are also required to disclose illiquid securities in the portfolio, the investment made in rated and unrated debt securities, non-performing assets (NPAs), etc.

Yes, there is a difference. Initial Public Offering (IPO) is offered by a company to directly raise money for the company as per the stated objective. In the case of mutual funds, the money garnered is used for investing in eligible securities such as equity and debt instruments of companies, money market instruments, gold, etc. Thus, a mutual fund acts as an intermediary between investors and companies.

Some of the investors have the tendency to prefer a scheme that is available at lower NAV compared to the one available at higher NAV. Sometimes, they prefer a new scheme which is issuing units at INR 10 whereas the existing schemes in the same category are available at much higher NAVs. Investors may please note that in the case of mutual fund schemes, lower or higher NAVs of similar types of schemes of different mutual funds have no relevance. On the other hand, investors should choose a scheme based on its merit considering the performance track record of the mutual fund, service standards, professional management, etc. This is explained in an example given below.

Suppose scheme A is available at a NAV of INR 15 and another scheme B at INR 90. Both schemes are diversified equity oriented schemes. An investor has put INR 9,000 in each of the two schemes. He would get 600 units (9000/15) in scheme A and 100 units (9000/90) in scheme B. Assuming that the markets go up by 10% and both the schemes perform equally good and it is reflected in their NAVs. NAV of scheme A would go up to INR 16.50 and that of scheme B to INR 99.

Thus, the market value of investments would be INR 9,900 (600* 16.50) in scheme A and it would be the same amount of INR 9900 in scheme B (100*99). The investor would get the same return of 10% on his investment in each of the schemes. Thus, lower or higher NAV of the schemes and allotment of the higher or lower number of units within the amount an investor is willing to invest, should not be the factors for making an investment decision. Likewise, if a new equity oriented scheme is being offered at INR 10 and an existing scheme is available for INR 90, NAV should not be a factor for decision making by the investor. Similar is the case with income or debt-oriented schemes.

On the other hand, it is likely that the better managed scheme with higher NAV may give higher returns compared to a scheme which is available at lower NAV but is not managed efficiently. Similar is the case of fall in NAVs. An efficiently managed scheme at higher NAV may not fall as much as inefficiently managed scheme with lower NAV. Therefore, the investor should give more weightage to the professional management of a scheme instead of lower NAV of any scheme. He may get a much higher number of units at lower NAV, but the scheme may not give higher returns if it is not managed efficiently.

As already mentioned, the investors must read the offer document of the mutual fund scheme very carefully. They may also look into the past track record of performance of the scheme or other schemes of the same mutual fund. They may also compare the performance with other schemes having similar investment objectives. Though the past performance of a scheme is not an indicator of its future performance and good performance in the past may or may not be sustained in the future, this is one of the important factors for making an investment decision. In the case of debt oriented schemes, apart from looking into past returns, the investors should also see the quality of debt instruments which is reflected in their rating. Similarly, in equities schemes also, investors may look for the quality of the portfolio. They may also seek the advice of experts.

Investors should not assume some companies having the name “mutual benefit” as mutual funds. These companies do not come under the purview of SEBI. On the other hand, mutual funds can mobilize funds from the investors by launching schemes only after getting registered with SEBI as mutual funds.

Almost all mutual funds have their own websites. Investors can also access the NAVs of all mutual funds at the website of Association of mutual funds in India (AMFI) www.amfiindia.com.

Investors can log on to the website of SEBI www.sebi.gov.in and go to “Mutual Funds” section for information on SEBI regulations and guidelines, data on mutual funds, draft offer documents filed by mutual funds, etc. Also, in the annual reports of SEBI available on the website, information on mutual funds is given.

There are a number of other websites which give a lot of information about various schemes of mutual funds including returns over a period of time. Many newspapers also publish useful information on mutual funds on a daily and weekly basis.

Investors may also approach their financial experts and distributors to guide them in this regard.

Mutual Funds provide on their website, the list of names and addresses of investors in whose folios there are unclaimed amounts (dividend/redemption). The information provided herein shall contain the name of the investor, address of investor, and name of Mutual Fund/s with whom unclaimed amount lies.

The website of Mutual Funds is also required to provide information on the process of claiming the unclaimed amount and the necessary forms/documents required for the same.

The information on the unclaimed amount along with its prevailing value (based on income earned on the deployment of such unclaimed amount)is separately disclosed to investors through the periodic statement of accounts/CAS sent to the investors.

Yes. The nomination can be made by individuals applying for/holding units on their own behalf singly or jointly. Non individuals including society, trust, body corporate, partnership firm, Karta of Hindu Undivided Family, holder of Power of Attorney cannot nominate.

In case of winding up of a scheme, the mutual funds pay a sum based on prevailing NAV after adjustment of expenses. Unit holders are entitled to receive a report on winding up from the mutual funds which gives all necessary details.