Key Man Insurance

Employer – Employee Insurance

Group Term Life Insurance

Key Man Insurance

What is Keyman Insurance?

Keyman insurance is taken by a business firm on the life of key employee(s) to protect the firm against financial losses, which may occur due to the premature demise of the Keyman. Key employee or keyman is a term used specifically for an important employee or executive who is core to the operation of the business and his death, disability or absence could prove to be disastrous for the company or organization.

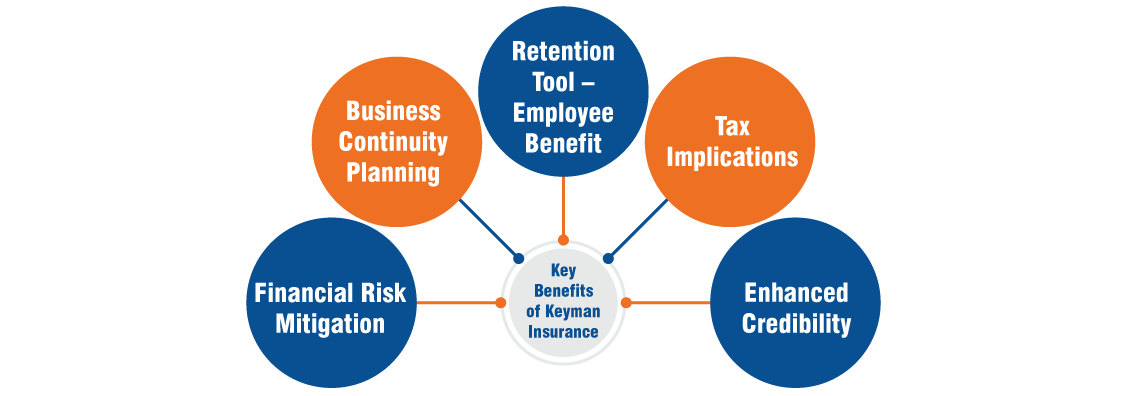

Key Benefits of Keyman Insurance

1. Financial Risk Mitigation

In the event of the unfortunate death of the insured key person, the company receives a lump-sum death benefit, helping it:

Cover business losses

Hire and train replacements

Maintain creditor and investor confidence

Support continuity in operations

2. Business Continuity Planning

Demonstrates that the company is forward-thinking and prepared for unforeseen risks, especially during funding, mergers, or acquisitions.

3. Retention Tool – Employee Benefit

The company can assign the policy to the key employee (with or without a vesting period), turning it into a retention and loyalty tool.

This creates a deferred benefit or bonus

Encourages long-term association with the organization

4. Tax Implications

Premiums paid are typically treated as a business expense (subject to conditions under the Income Tax Act).

However, death proceeds are taxable as they accrue to the business (not under Section 10(10D)).

5. Enhanced Credibility

- When approaching banks, VCs, or strategic partners, having Keyman Insurance displays sound risk management.

- Useful during due diligence and valuation for funding rounds or IPOs.

Keyman Insurance: A Strategic Tool for Business Protection and Employee Retention

Keyman Insurance is a life insurance policy taken by a business on the life of an important employee, where the employer is the proposer, premium payer, and beneficiary. It is an effective risk management strategy to safeguard the financial impact arising from the loss of a key resource.

Benefits of Keyman Insurance to the Employer:

Cost-Effective Risk Management: Offers a financially efficient way to safeguard your business from the sudden demise or exit of a key employee.

Replacement Cost Cushion: The death benefit received by the employer provides liquidity to cover recruitment, training, and loss of revenue associated with the key employee’s absence.

Flexibility on Policy Exit: If the employee exits the organization, the employer has the option to surrender the policy and receive its surrender value.

Benefits to the Employee (In Case of Policy Assignment):

- Employer-Funded Savings Tool: The premiums are paid by the employer during the tenure, serving as a long-term saving instrument for the employee post-assignment.

- Life Insurance Coverage Post Assignment: Once the policy is assigned, the employee enjoys life cover benefits under the same policy

When Should You Consider Keyman Insurance?

Keyman Insurance is ideal for:

Businesses that heavily depend on the expertise or relationships of a few individuals.

Firms looking to create long-term incentives for top performers.

Companies aiming for financial stability and succession planning.

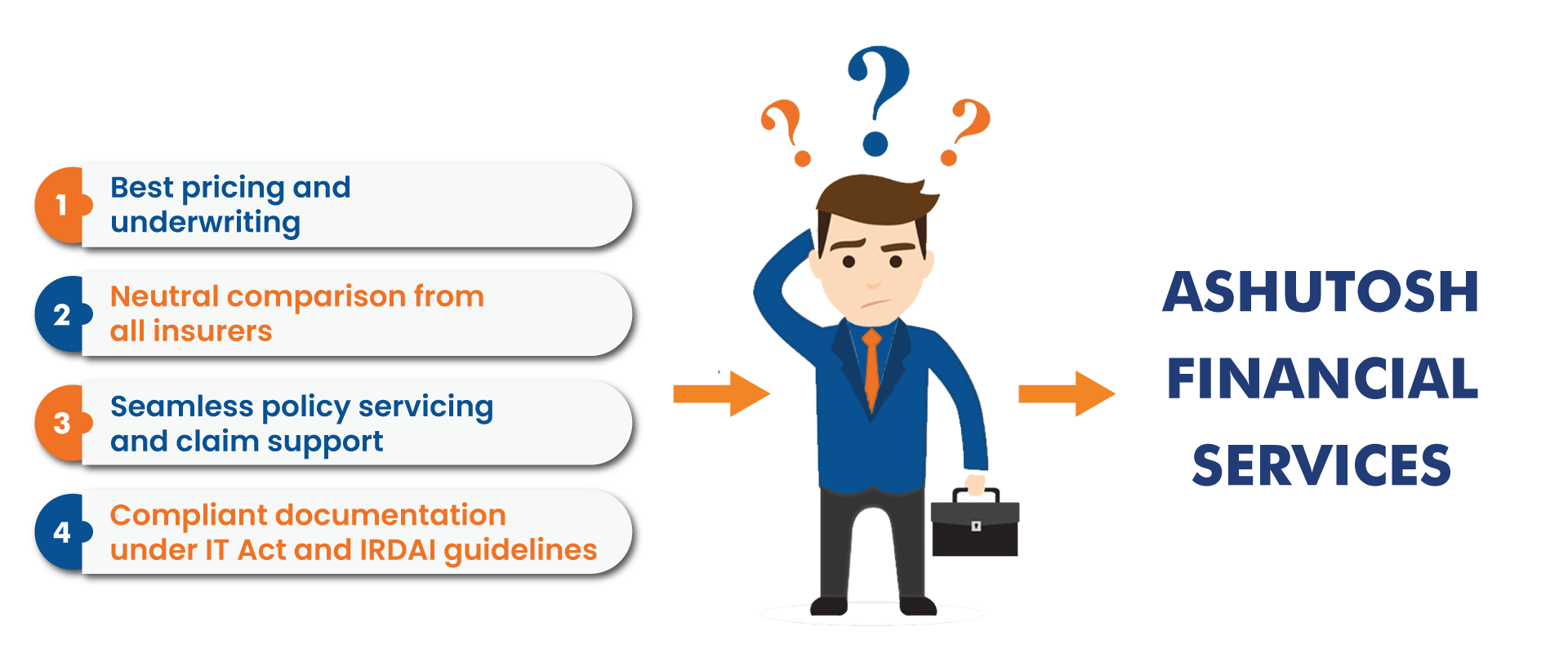

Why Ashutosh Financial Services?

Ashutosh Financial Services is your one-stop insurance service provider. Our sister concern Ashutosh Insurance Brokers LLP is a Certified Insurance Broker. After qualifying and satisfying various conditions like adequate physical & digital Infrastructure, a qualified team, clearance of requisite exams by Key Personnel, satisfactory capital & net worth requirements, etc. we have obtained the license of Life & General Insurance Broker from the Insurance & Regulatory Authority of India (IRDA).

As an Insurance Broker, we no longer offer Insurance policies of a few selected companies instead, we now offer you the best Insurance Policies by comparing all the policies of all the companies. Our expert and qualified team will carefully select the best Insurance Policy for you after studying your requirements. We assure you that we will provide you with the best Insurance solutions at the most competitive premium rates.

Preliminary

Discussion

In our first meeting we would try to understand your purpose and objectives for taking a general insurance policy. We would also explain to you various important terms of a general insurance policy like – policy cover, risks covered, claims allowed, etc. A proper understanding of these terms would help you in determining the general insurance coverage needed by you in a better way. We would also collect information about you to enable us to select the best general insurance policy for you.

Research

&

Analysis

We at Ashutosh Financial Services take immense pride in being one of the very few companies in this field to have our own in-house Research & Analysis Department. After the preliminary meeting is concluded we forward our analysis to our Research Department who as Certified Insurance Brokers will compare all the general insurance policies of all the companies as per your requirements and select the best general insurance policy for you at the most competitive rate.

Insurance

Subscription

Process

Once the best policy is selected and approved by our top management we will approach you again with all the necessary documents (Forms, Policy Information & Benefits, etc). If you have any doubts we will solve them before we proceed to log in to your general insurance policy

After

Subscription

Service

Once the Investment Process has been completed you will be assigned a Dedicated Relationship Manager. The Relationship Manager will be available at all times to attend to all your needs. Moreover, the Relationship Manager will also inform you about your general insurance premium dates as and when they become due. Moreover, we also help and guide you at all times in matters relating to claim settlement. Our qualified team has years of experience in settling claims with various insurance companies.

Our Key USPs are as under:

Employer – Employee Insurance

What is

Employer – Employee Insurance?

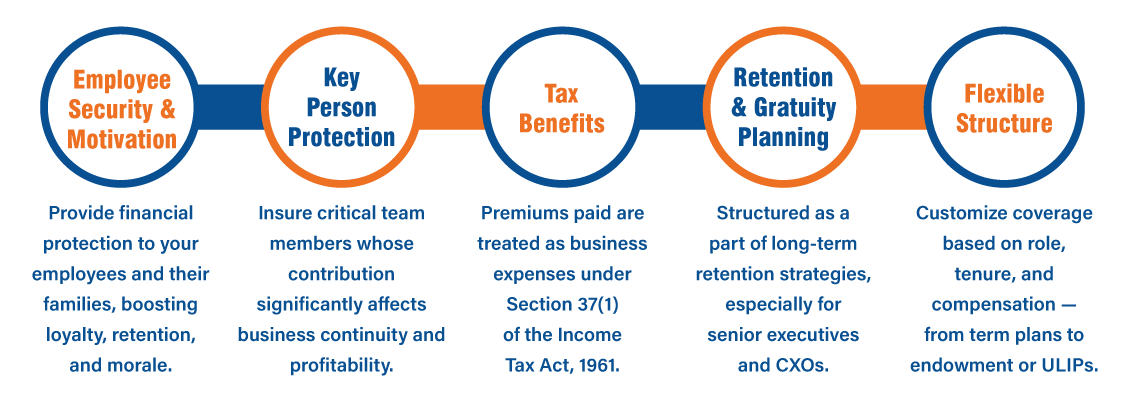

Employer–Employee Insurance is a life insurance arrangement where the employer takes a life insurance policy on the life of the employee, with the employer as the proposer and premium payer, and the employee’s family as the beneficiary. This is a strategic financial planning tool that not only ensures employee welfare but also offers tax advantages to the employer.

Importance of Employer–Employee Insurance

How It Works?

Policy is purchased by the Employer

Employer is the proposer and premium payer

Employee’s life is insured

Sum assured depends on employee’s role and income

Nominee is the Employee’s Family

Ensures death benefit goes directly to the loved ones

Policy Assignment Option

After a specific period or at retirement/resignation, the policy can be assigned to the employee

Who Should Opt for This Plan?

Popular Plans under Employer–Employee Arrangement

- Group Term Life Insurance – Pure risk coverage

- Endowment Plans – Insurance + guaranteed savings

- ULIP Plans – Market-linked returns + protection

- Whole Life Plans – Lifetime coverage for key personnel

Why Ashutosh Financial Services?

At Ashutosh Insurance Brokers LLP, we are a licensed direct broker helping corporates structure the most suitable employer–employee insurance schemes by comparing plans across all major insurance companies. Whether you’re insuring a key employee or setting up a long-term benefit plan, we ensure:

Ashutosh Financial Services is your one-stop insurance service provider. Our sister concern Ashutosh Insurance Brokers LLP is a Certified Insurance Broker. After qualifying and satisfying various conditions like adequate physical & digital Infrastructure, a qualified team, clearance of requisite exams by Key Personnel, satisfactory capital & net worth requirements, etc. we have obtained the license of Life & General Insurance Broker from the Insurance & Regulatory Authority of India (IRDA).

As an Insurance Broker, we no longer offer Insurance policies of a few selected companies instead, we now offer you the best Insurance Policies by comparing all the policies of all the companies. Our expert and qualified team will carefully select the best Insurance Policy for you after studying your requirements. We assure you that we will provide you with the best Insurance solutions at the most competitive premium rates.

Preliminary

Discussion

In our first meeting we would try to understand your purpose and objectives for taking a general insurance policy. We would also explain to you various important terms of a general insurance policy like – policy cover, risks covered, claims allowed, etc. A proper understanding of these terms would help you in determining the general insurance coverage needed by you in a better way. We would also collect information about you to enable us to select the best general insurance policy for you.

Research

&

Analysis

We at Ashutosh Financial Services take immense pride in being one of the very few companies in this field to have our own in-house Research & Analysis Department. After the preliminary meeting is concluded we forward our analysis to our Research Department who as Certified Insurance Brokers will compare all the general insurance policies of all the companies as per your requirements and select the best general insurance policy for you at the most competitive rate.

Insurance

Subscription

Process

Once the best policy is selected and approved by our top management we will approach you again with all the necessary documents (Forms, Policy Information & Benefits, etc). If you have any doubts we will solve them before we proceed to log in to your general insurance policy

After

Subscription

Service

Once the Investment Process has been completed you will be assigned a Dedicated Relationship Manager. The Relationship Manager will be available at all times to attend to all your needs. Moreover, the Relationship Manager will also inform you about your general insurance premium dates as and when they become due. Moreover, we also help and guide you at all times in matters relating to claim settlement. Our qualified team has years of experience in settling claims with various insurance companies.

Our Key USPs are as under:

Group Term Life Insurance

What is Group Term Life Insurance?

A Group Term Plan is a type of life insurance policy that covers a group of people, typically employees of a company or members of an organization. It provides life insurance coverage to all individuals in the group for a specified term or period, which is generally renewable on an annual basis.

TYPES OF GROUP TERM PLAN

EMPLOYER-EMPLOYEE:

- Employee means a person in the permanent employment of the Employer, and shall include a person who is on probation for a permanent post but shall not include a trainee/apprentice or a personal or domestic, servant.

- Employer means the Company, firm or body corporate which is mentioned on the Policy Schedule or a Company, firm or body corporates which may in future manage or control the named Employer.

NON-EMPLOYER-EMPLOYEE

- As the term individual suggests, it is an insurance plan that an individual can purchase for his/herself whereas non-employer group cover is a type of insurance policy that can be purchased by a group of people such as people living in a society, cultural association or people working together.

Benefit of Group Term Life Insurance

- Default Insurance cover

A group insurance policy provides insurance cover to members by simply being part of the group. It ensures

basic insurance to cover those who do not have a personal life insurance policy. - Tax Benefits

Group Term Life Insurance plans offer tax benefits to both employers and employees. As per prevailing Tax

Laws, Death benefits are exempt from tax under Section 10(10D) of the Income Tax Act, 1961. Moreover,

group insurance plans are doubly effective in employee welfare as well as retention. - Customizable to suit employee needs

Group insurance policy coverage can be extended with add-ons like Terminal Permanent Disability, accidental

death and more, thus covering a multitude of benefits along with the base cover. - Cost-Effective

Since a group plan entails insurance cover for many people, its premium is much lower as compared to individual policies. Undoubtedly, a group insurance policy is a smarter way to avail insurance protection against multiple risk factors, let alone life. Start by assessing the right group term plan. - Premium

The premium is directly proportionate to the number of group members. As the number of members grows, so does the premium rates, and vice versa. If the insurer collects any excess premium money, it will refund to the organisation. - Affordable

Group term life insurance is less costly than individual term life insurance plans. This is because the insurance provider will combine different costs, including management, maintenance, and renewal into a single master policy. - Coverage

The amount of coverage provided under some group term life insurance plans depends on a member’s place and rank in the organization. Benefits for the top management are significantly higher than those at the lower levels. Some small and medium-sized businesses, on the other hand, offer uniform, flat coverage to all coverage to all their workers. - Tenure

The policy typically has a one-year limit. After that, the policy must be renewed every year.

Why Ashutosh Financial Services?

Ashutosh Financial Services is your one-stop insurance service provider. Our sister concern Ashutosh Insurance Brokers LLP is a Certified Insurance Broker. After qualifying and satisfying various conditions like adequate physical & digital Infrastructure, a qualified team, clearance of requisite exams by Key Personnel, satisfactory capital & net worth requirements, etc. we have obtained the license of Life & General Insurance Broker from the Insurance & Regulatory Authority of India (IRDA).

As an Insurance Broker, we no longer offer Insurance policies of a few selected companies instead, we now offer you the best Insurance Policies by comparing all the policies of all the companies. Our expert and qualified team will carefully select the best Insurance Policy for you after studying your requirements. We assure you that we will provide you with the best Insurance solutions at the most competitive premium rates.

Preliminary

Discussion

In our first meeting we would try to understand your purpose and objectives for taking a general insurance policy. We would also explain to you various important terms of a general insurance policy like – policy cover, risks covered, claims allowed, etc. A proper understanding of these terms would help you in determining the general insurance coverage needed by you in a better way. We would also collect information about you to enable us to select the best general insurance policy for you.

Research

&

Analysis

We at Ashutosh Financial Services take immense pride in being one of the very few companies in this field to have our own in-house Research & Analysis Department. After the preliminary meeting is concluded we forward our analysis to our Research Department who as Certified Insurance Brokers will compare all the general insurance policies of all the companies as per your requirements and select the best general insurance policy for you at the most competitive rate.

Insurance

Subscription

Process

Once the best policy is selected and approved by our top management we will approach you again with all the necessary documents (Forms, Policy Information & Benefits, etc). If you have any doubts we will solve them before we proceed to log in to your general insurance policy

After

Subscription

Service

Once the Investment Process has been completed you will be assigned a Dedicated Relationship Manager. The Relationship Manager will be available at all times to attend to all your needs. Moreover, the Relationship Manager will also inform you about your general insurance premium dates as and when they become due. Moreover, we also help and guide you at all times in matters relating to claim settlement. Our qualified team has years of experience in settling claims with various insurance companies.

Our Key USPs are as under: